Do you want to sell your house fast?

Table of Contents

Are you thinking about “cash buyers”? I understand; you’re here because you want to make the right decision. You’re comparing options to sell your house fast in a competitive market. You’re wondering, whether selling for cash to an investor is the right solution.

There can be competing thoughts. Selling a house is not easy, especially if you’re short on time. Give me a few minutes from your busy schedule, and I will give you all the details about selling your home to an investor. After reading this article, you will know whether you should accept that cash offer or not. I will guide you about the offer calculation process that’s not advertised by those “we buy houses companies”.

For easy navigation, I’ve divided this guide into 4 sections. You can click on your specific question to read the answer.

Should I Sell My House Without a Realtor?

That’s the first question in your mind. Should I really think about selling without an agent? Can I sell my house without an agent?

I hear you!

Many people are frustrated with the real estate process. In my experience, most people are not worried about the cost of hiring an agent. They are worried about finding an experienced realtor who will deliver on promise. You don’t want to pay 6% in commission just to secure a spot on the MLS. You want guidance, aggressive marketing, and a high selling price.

The high commission is an issue because the cost is often thousands of dollars.

Time is another issue.

How do you find the best agent to sell your home? You can ask friends and family members. You can search online. You’re lucky if you know a trustworthy agent. Otherwise, you’re relying on online reviews and BBB ratings. I am not saying you can’t find a reputable agent. The issue is that it takes time. You can expect to spend a couple of weeks before you can start working with your realtor. Even after hiring, I can hear questions in your head:

- Did I make the right decision?

- When will my house sell?

- What’ll be the price?

- How will we find the buyers?

- Do I have to do a lot of work along with my agent?

These questions remain unanswered until your agent successfully sells your home and you receive the amount.

Now, let’s say, you want to sell your house without a realtor. You don’t want to publish a listing on the MLS. You have two options left now:

Sell your house by owner (FSBO)

Sell your house for cash (work with cash buyers or investors)

Let’s first explore FSBO. You can publish a FSBO listing or choose a private way to handle the sale.

Real Estate For Sale By Owner:

How do I sell my home without a realtor? Or how do I sell my house by owner? In this post, we’ll compare both options to help you decide.

FSBOs have a reputation for getting you a lower price. However, an FSBO property doesn’t necessarily sell for a lower price. You’ll often find twisted statistics on the internet.

For example, you might read that a certain percentage of people end up hiring an agent. Or FSBO properties sell for ….% less price than agent-assisted properties.

There is a problem with those statistics. Before I explain the issue, let me ask you a question:

Scenario #1: Joe has a small income and a small property worth $50k. He works full-time, but he wants to relocate to a different area. Now, when he’s planning to sell, he doesn’t want to spend $3,000 on realtor commissions.

Furthermore, his house doesn’t have market appeal. So he won’t get too many interested buyers even after hiring an agent.

Scenario #2: Barbara owns a home worth $300k in a lovely suburb. She and her husband are planning to move into a better school town, so they are planning to sell the house. The property is in good condition but could use some updates.

Who do you think will hire an agent? Who will end up choosing FSBO? What’s your opinion?

Please share in the comments.

I am waiting for your answer.

Maybe you’re waiting to hear from me. The truth is, we don’t know. However, I can predict that Barbara will choose to hire an agent. In contrast, Joe is a handyman and might decide to sell by owner.

That’s the issue. Most low-priced properties are not listed with agents. So an agent will sell a house worth $300,000. The FSBO property is priced at $50k. When stats come, you’ll see that FSBO properties sell for a lower price. However, that’s not the truth. If you want to sell your home by owner, you don’t have to lower the price. You don’t have to reduce the price because you’re saving on commission.

You might sell for a discounted price because you’re in a hurry or you get to avoid home inspection. Please note that the statistics on the web are often twisted to make a point. Most people choose a real estate agent for selling a property, and that’s fine. If you want to choose FSBO, you just need to pay yourself extra money and be willing to do the marketing work.

So, Should I Sell My House by Owner?

I hope you get some encouragement from the pricing truth. Now, let’s talk about your savings and why FSBO is a bad idea from a financial perspective.

Buyer Agent Commissions:

That’s the point I hate about FSBO. What’s the point of all effort if I have to pay commissions? I want to sell my house by owner to avoid commissions. However, you’re responsible for paying for buyer’s agent commissions. You can negotiate with the buyer, but the result is not guaranteed.

So, your actual savings become 3%.

Listing on the MLS & FSBO Websites:

You can market your property on the MLS using flat-fee services or marketing packages offered on the FSBO sites. You can get these services for a small fee.

Suppose you pay 0.5% (of your home value) on marketing packages, open houses, and advertising. Now we just need to talk about the 2.5% commission.

Should I spend another 2.5% on hiring an agent to sell my house fast? Or can I save 2.5% and still sell my house fast for a reasonable price? The answer will vary from situation to situation.

Some FSBO websites also offer agent services for a small commission, like 0.5%-1%.

In my experience, that’s the sweet spot if you want to sell your home by owner. You can receive support from an agent without paying a hefty fee. And that brings me to another “twisted fact” on the internet. When you sell house by owner, you’re not actually saving on 6% commission. You’re dealing with numbers ranging from 1% to 2% profit. In some cases, it’s best to list your home on a FSBO website and avoid paying high commissions. However, for most people, listing with an experienced agent can bring better results.

Is It Better to Sell My House Fast for Cash?

Maybe, maybe not. That’s where real estate investors play their part. This section will give you a detailed review of working with real estate investors. We’ll discuss:

- Should I sell my home to an investor?

- How do “we buy houses companies” calculate your fair offer?

- How and why do real estate investors work with you?

- How much do cash buyers pay for houses?

- How can you find a trustworthy & reputable real estate investor?

- How do you differentiate between a reliable and wannabe investor?

Should I Sell My House to an Investor?

Is it better to list your home on the MLS? Or is it better to get a direct cash offer?

What’s the answer?

I suggest going with the method that pays you the most. So you need to calculate the cost of time, marketing, effort, and repairs, and then the answer will guide you. In a moment, I will show the actual sample calculations. Real estate cash buyers in your area use this sample calculation. They are running a business, so they need to understand the profit/loss analysis before they can buy your property. Even if you’re planning to sell with an agent, the estimate is helpful.

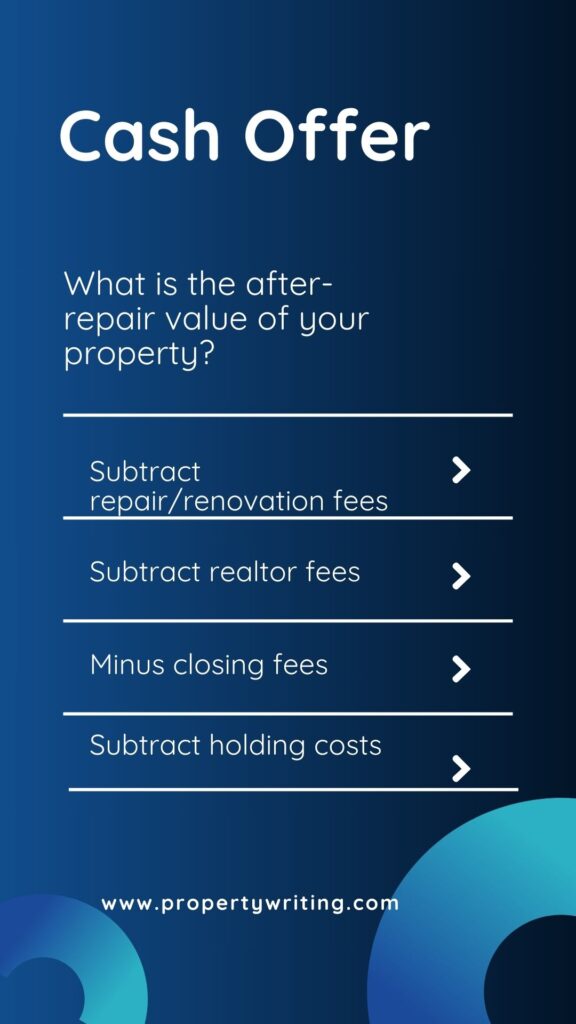

How do “we buy houses companies” calculate your fair offer?

Always ask for this calculation before selling your home to a real estate investor. Doing so gives you two benefits. First of all, you can see the analysis. Second, you can see if you’re working with a wholesaler or an investor.

After-Repair Value: Most real estate investors begin their calculation from this number. So, ARV is the value of your home after it has been renovated according to market standards. That might mean getting new appliances, roof, and boiler.

How do I calculate the ARV of my house? You can ask any real estate expert in your area to give you the estimate. Please don’t rely on cash offers because the numbers can be misleading. Instead, I will suggest talking to 3 real estate agents in your area and getting a free home valuation report. Ask them to guide you about the ARV. Those 3 calculations will definitely give you an idea of the average value. You can decline a cash offer if it proposes a low ARV.

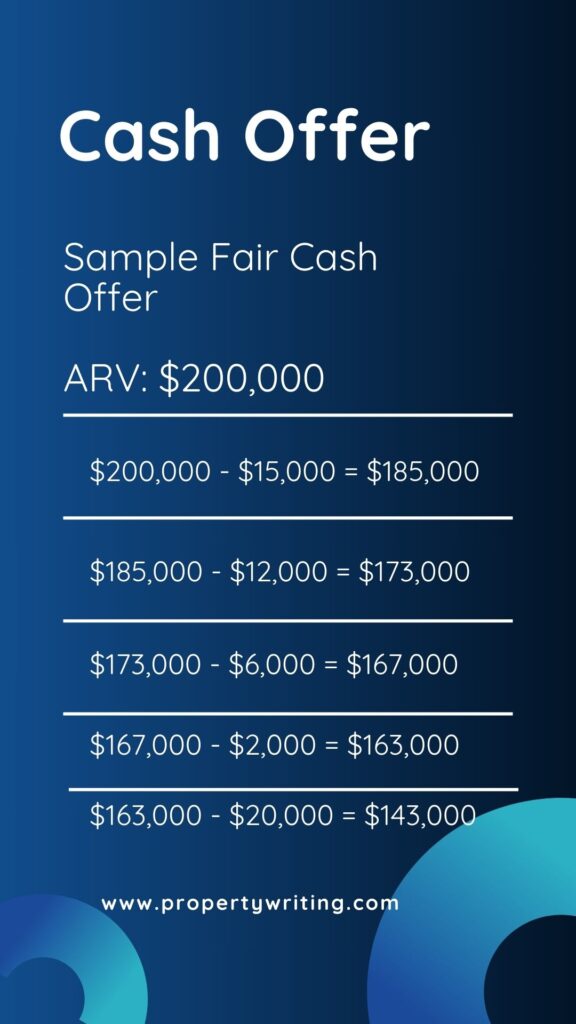

Suppose the ARV of your house is $200k. That means, after remodeling, you can sell your home for $200,000.

Let’s see how much cash you will get if you sell your house fast to an investor.

Cost of Repairs:

What’s the cost of remodeling your property? How much will it cost to update your house? Depending on your home’s condition, you might need to do some extensive work like updating the curb appeal, replacing HVAC, or fixing the roof.

You can request quotes from contractors in your area. Most contractors will give you a fair bid. You will get an estimate if you compare three quotes from different contractors.

Your real estate investor (or we buy houses company) will also do the same. The cash buyer will calculate the cost to repair your house. However, “we buy houses” companies have a dedicated crew. They work with contractors to get a discounted price. You won’t get the same price if you’re repairing the property.

Now let’s resume our calculation. Suppose the cost of rehabbing your house is $15,000.

$200,000 – $15,000 = $185,000

What’s the Cost of Selling Your Property?

You sell your house fast for cash without involving a real estate agent. However, a real estate investor will sell the house after rehabbing it. So they will be paying some commissions. And they are going to subtract the commission from your cash offer.

Average commission = 6% of the sales price

$185,000 – $12,000 = $173,000

“We buy houses companies” also pay for closing costs. Roughly speaking, closing costs are 2%-3% of the sales price. That includes the closing costs paid for buying your property.

$173,000 – $6,000 = $167,000

Now, these are the costs you will bear even if you’re selling with an agent. Let’s move to the next section.

Sell My House Fast to a Real Estate Investor

Real estate investors purchase properties to make a profit. That’s true about wholesalers and “we buy houses” companies. But the “house-buying” business is not all about earning profit. Investors have their business expenses. Sometimes, they hold a house for 12-24 months before they can sell it for a profit.

Holding any house will cost you money (maintenance, security, insurance, utilities, and interest-rate). Every home is different, but you can expect that cost to be around 1%. After paying for the expenses, the investor needs to make some profit.

Business Profit: Businesses need to survive and they need a profit. Any genuine investor will tell you about the profit margin. Wannabe investors might say, We’re not keeping profit. That’s not true and shouldn’t be. Serious investors have a business plan and they work accordingly. Now the profit margin can vary from investor to investor. Some investors are doing 50+ deals each year and they might operate on a reduced margin. However, I have seen that the profit margin is 10%–12%.

So the 12% profit will be $40k.

$167,000-$20,000 = $143,000

The result is $143k, which can be your cash offer. Some real estate investors go by the 70% rule.

What is 70% of ARV Rule in Real Estate?

According to this rule, maximum cash offer can be 70% of the estimated value. In our case, that’ll be $140k which is quite close to our original calculation.

Back to the question: should I sell my house to an investor? Is it worth selling your house to a “we buy houses” company?

Read the online forums and general articles. You’ll hear that investors only pay 50% of the property’s value. (Not true unless the property is completely damaged). You’ll hear that you lose thousands in the game. Again, that’s not true. Just like you don’t save 6% commission in a FSBO transaction.

Yes. It’s going to be a financial loss if you sell your house to investor. In this calculation, our financial loss is $24k-$27k. That’s not 50% of your home’s value. You’ll have to pay for commissions, closing costs, and utilities if you list on the MLS. So I am not counting that in our calculation. We need to determine the exact numbers and then compare those numbers with the service provided.

Can I Refuse to Sell My House Fast to an Investor?

Of course. Most real estate investors will ask for a contract. However, there also an exit clause or you can add one. It happens with foreclosure properties. You are negotiating with your bank, but you’re also talking to a real estate investor. You don’t want to lose your home but in the worst-case scenario, you want to protect your credit score.

Let’s say you reach an agreement with your bank and the foreclosure stops. Now what? You don’t have to sell your house to a cash buyer. You can refuse to sell your home to an investor. The exit clause must be a part of your real estate contract. Please don’t sign the contract without first reading it 3 times. Real estate investors are quick with legal procedures. They have their drafts ready and know where you need to sign. However, you must sign only after a thorough review. Folks are scammed when they transfer the home title, yet they are responsible for mortgage payments. These scams happen because of a lack of information. You cannot transfer the property title until you’re at the closing table and receiving cash from the escrow company. Always choose a local title company to close the deal.

How Can I Choose a Cash Buyer for My House?

You have a few options. Search online, “sell my house fast + your location” and hundreds of companies will appear. You can see, “we buy houses signs” everywhere.

How do you choose the most reliable company to work with?

You can choose between a local real estate investor or a national company. Some companies like “fast home offer” or “we buy ugly houses” are franchies. They operate nationwide through a network of real estate investors. They will get you quick cash for the property. They can also offer a personalized experience through their network.

A local investor is often an individual who is looking to earn money by investing in the local market. Most local investors only work in their cities. They are familiar with the market. Working with a local investor helps with the pricing. You might receive a better cash offer if you work with a local cash buyer in your neighborhood. You can also get testimonials from people who have worked with the cash buyer. Another option is to meet the actual investor, ask questions and get a feel for their process. Always trust your gut feeling.

Avoid working with a wholesaler if you are short on time. A wholesaler doesn’t have the funds to purchase your house. The wholesaler will put the house under contract and will find you a buyer.

The problem is that you earn less with wholesaler and there is a chance of last-minute cancellation if the wholesaler can’t find an investor.

How Do I Work with a “We Buy Houses” Company?

Do your due diligence before working with a real estate investor. I believe you need to judge if you are working with an honest person. There are a couple of ways to do that.

Find the homes rehabbed by the investment company. Maybe attend an open house if they are selling a property. See the quality of the work. Are they fair with the renovation process?

Check all the client testimonials and try to contact the previous sellers or buyers. See if you can get an actual review.

- Talk directly to the investor and inquire about their process.

- Request proof of funds.

- Ask about the contract language. Will you have an exit strategy after you have signed the contract?

- What is the cost of repairing your property?

- Talk about their team and network. Who are the contractors? Do they work with attorneys? Which title company is their favorite?

- And also request if you can get any favor. (It can be anything, just ask to see their response.)

Did I miss anything here?

Leave your comments below and tell me how was your experience working with a real estate investor in your area? What precautionary measures did you take before working with a cash buyer? Do you prefer working with “we buy houses” companies?

Leave a Reply