FHA 203k vs. Homestyle Loan: Which One is Better?

If you’re curious about investing, then learning about renovation loans is a must. Today, we are talking about two popular renovation loans:

- FHA 203(k) loan

- Fannie Mae homestyle renovation loan

FHA 203k and Fannie Mae homestyle loans are slightly different from each other. With these loans, you can finance the home purchase plus the repairs.

Why do I need a renovation loan?

Do you want to renovate a distressed property? A traditional bank won’t lend you money. You cannot get financing for a home with broken windows or a damaged roof. The house has to comply with the FHA lending requirements. That’s why you need to choose a renovation loan that fits your situation.

Why is a renovation loan necessary for investors?

Getting a renovation loan is often the first step for new investors. A renovation loan provides an ideal start if:

- You’ve been wanting to invest in real estate but a lack of capital has held you back

- You don’t want to go after private money lenders.

You can start with a minimum down payment and favorable interest rates.

| Loan Feature | FHA 203k | Homestyle Renovation |

| Minimum credit score | 500 (10% down), or 580 (3.5% down) | 620 |

| The minimum down payment | 3.5% (credit score under 580) or 10% (credit score above 580) | 5% |

| Loan Limit (Single-Family) | $498,257 (most areas) to $1,149,825 (high-cost areas). | $766,550 (conventional mortgage limit) |

| Mortgage Insurance | An annual mortgage insurance fee and a one-time fee is applied if your down payment is less than 20%. | An annual mortgage insurance fee is applied if your down payment is less than 20%. |

| Loan Purpose | Primary residence, including 1-4 units multifamily property | Primary residence, 1-4 unit multifamily, secondary homes and investment homes |

Key Takeaway:

- Both loans (FHA 203k & Homestyle) allow you to borrow money against the after-repair value. So if the current value is $200k but after the repairs, the value will be $285k, then lenders will consider $285k. That’s more than a traditional home equity loan or line of credit.

What are FHA 203K and Homestyle Renovation Loans?

A 203(k) mortgage is backed by FHA, while a homestyle loan is backed by Fannie Mae. Both loans are designed for low-income families that want to invest in a fixer-upper. The idea is to lend money for distressed homes to create homeownership opportunities.

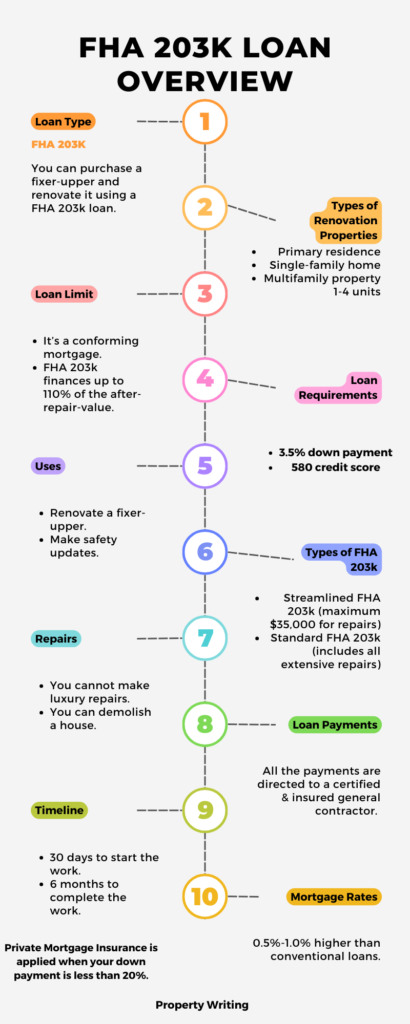

FHA 203k Overview

How Can You Use FHA 203(k) for Renovations?

FHA 203k is reserved for renovating a primary residence. That means you need to live in the house for one year after rehabbing. You cannot sell or rent the house during that period. So FHA 203k is solely designed for first-time homebuyers or those planning to spend at least one year in the property.

Overview of FHA 203k Loan Requirements:

- You can qualify with a 3.5% down payment and a credit score of 500, but a 580 is preferred.

- You cannot make luxury updates to the house. It’s not possible to add a pool or other luxury features.

- FHA 203k comes in two varieties.

- The total amount of the mortgage must be within the limitations of a conforming mortgage. Check the maximum borrowing limit for a conforming mortgage in your county and proceed accordingly.

- Your debt-to-income ratio must be less than 43%.

- You can renovate single-family homes, condos, manufactured houses built after 1978, and multifamily houses (1-4 units).

Why is a FHA 203k good for wealth building?

Most first-time buyers are just looking at their dream of home ownership. They want a place to call home, and that’s it. But to build wealth, you need to look beyond. If you buy a house, you will need to make a down payment and continue to make mortgage payments. But there is one thing that you can do to improve your financial situation. Let me demonstrate.

You can buy a single-family residence for $500,000 in Dallas, TX. You can also buy a multifamily property for $779,000 in Dallas, TX. The specifics of the transaction will vary. I am using those numbers for illustration purposes.

You can finance a multifamily property using a FHA 203k loan. You will live in one of the units and other units will bring you rental income.

Rule for Investing in Multifamily Property

The property must be self-sufficient. Now, what is a self-sufficient property? It’s a home that pays for itself after considering vacancy rates. Let’s say the vacancy rate in your area is 25%. If 75% of your rental income can cover the mortgage payment, then the house is self-sufficient and you can finance the deal. Check FHA self-sufficiency test requirements.

Look at your market condition and see if investing in a multifamily home makes sense for you. For many people, it can be the beginning of their investment career.

How can I use FHA 203k for the renovation of a multifamily property?

You need to meet a couple of conditions:

- The property must be self-sufficient (we already discussed it above).

- You need to live in one unit for at least one year.

- You can renovate the property, but the total loan amount cannot exceed the maximum allowed for multifamily units.

- You can renovate a duplex, triplex, or quadruple. A 5-unit multifamily property won’t qualify for FHA 203k.

- The renovation process must begin within 30 days. The total renovation period is 6 months. So you need to rehab your multifamily property within 6 months of closing the loan.

- The same rules apply for single-family homes, but the house doesn’t have to generate any income.

Which renovations can I make with FHA 203k?

The FHA 203k loan is offered in two variants. There is a limited (streamlined) version, and you can borrow $35,000 to repair your house. There is also a standard version that covers extensive repairs. Here is an overview of the repairs you can make with FHA 203(k) funds.

- You can demolish a house and construct it from scratch if required. The money from 203k can be used to pay for a rental home while the renovation work is being done.

- You cannot add luxury updates.

- You can renovate the house to make it sellable, comfortable, and safe.

- For standard 203k (exceeding $35,000), an HUD consultant is involved. You will need to submit your plan, or contractor’s bid, to the consultant. Payments are gradually approved as the work is done.

- You cannot pay yourself for the rehab work. You cannot use 203(k) funds to repair the house, even if you are a skilled handyman. All the funds are paid directly to the general contractor.

- If your down payment is less than 20%, you will pay a 1.75% upfront mortgage insurance premium. There is also a monthly MIP fee worth 0.80%.

How much money will I get with a FHA 203k mortgage?

What is the conforming mortgage limit in your area? If you are a New Jerseyan in Atlantic County, your limit is $498,257. Therefore, the maximum amount you can borrow is $498,257. That is just the upper limit. It doesn’t mean the bank will lend that much.

Your loan amount is calculated based on the after-repair value of the house. With FHA 203(k), you can borrow up to 110% of the ARV. However, the final amount must stay within your area’s mortgage limit.

FHA 203k Loan Approval Timeline

According to Abby Shemesh, Chief Acquisitions Officer, Amerinote Xchange, the timeline for FHA 203(k) loan approval typically ranges from 30 to 60 days. Basically, it depends on the complexity of the renovation project and how quickly required documents are provided.

- You need to provide standard mortgage application paperwork, which includes proof of income, tax returns, and credit report, among others.

- Submit contractor bids or estimates for the renovation work.

- Send a detailed proposal outlining the scope of renovations.

- Include an appraisal report factoring in the “after renovation” value.

Approval for FHA 203(k) loans can be more challenging than standard FHA loans because of the additional paperwork and the need for lender approval on renovation plans. A solid credit history and working with experienced contractors can help streamline the process.

Challenges in Acquiring FHA 203k Mortgage

I used an FHA 203(k) renovation loan to fund a large rehab project on a duplex property that I purchased to occupy and rent out the other unit. Based on my experience with that project, I would absolutely recommend FHA 203k to newbie investors. You can leverage the benefits of low-down-payment combined with favorable interest rates.

Other options, such as hard money loans, might have an interest rate that is much higher, even double or triple the rate you could get with an FHA loan, and would require more down payment.

There are some additional challenging aspects to consider, however. There is much more administrative effort involved in getting the project approved for the loan and with coordinating the loan draws as the project progresses. Some contractors may decline to work on a project funded by an FHA 203(k) loan due to the potential delay in payments and the additional administrative effort.

Jason Donajkowski, Broker / Owner, Paragon Property Management Group

Now let’s talk about the Fannie Mae homestyle renovation loan. After an overview, we will compare both mortgages as well as their pros and cons.

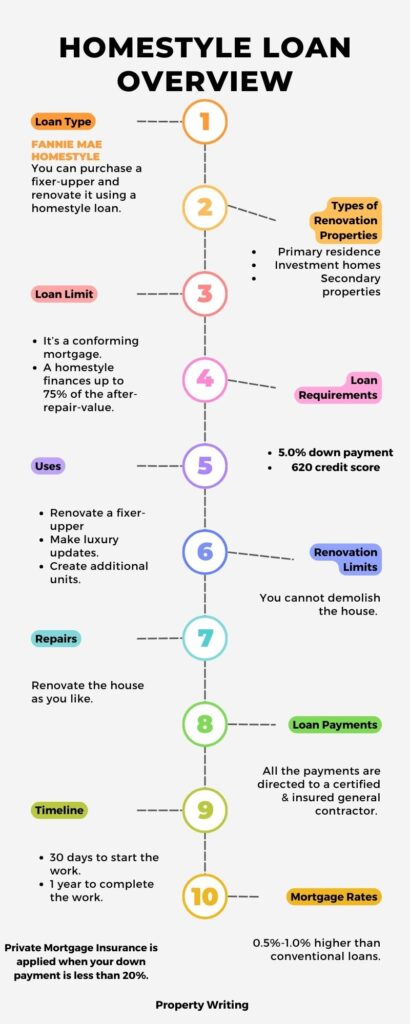

Overview of Fannie Mae Homestyle Renovation Loan

What is the Fannie Mae Homestyle Renovation Loan?

Fannie Mae HomeStyle allows you to finance home repairs along with the purchase. You need a minimum down payment of 5% and a credit score starting at 620.

The 5% down payment is only for renovating your primary residence. For a second home, you need to put down at least 10%. And for an investment home, the down payment increases to 15%.

Homestyle loans provide you with flexibility. You can borrow up to 75% of the after-repair value. A professional appraiser will confirm the ARV once you submit your renovation plan.

Eligible properties and renovations

A homestyle loan is ideal for repairing vacation homes and investment properties. You can add luxury amenities such as a swimming pool. You can create additional units or renovate an existing multifamily property.

Mortgage insurance and interest rates

For a homestyle loan, you simply pay an annual 0.4% insurance fee, which can be waived after you have 20% equity in the house.

The Renovation Process with Homestyle Loans

You don’t need a HUD consultant. The lender will put renovation funds in an escrow account, which will be released as the work is completed. With a homestyle loan, you can invest in extensive repairs (including structural work), and you have 12 months to finish the job.

You can also build an accessory unit, like a guest house or an apartment above the garage. The choice is yours. If you plan to sell your house after renovations, consider comparing recently sold homes in your area.

In summary, the Homestyle Renovation Loan offers a flexible way to finance home renovations. It has a longer timeline, allows for higher loan-to-value ratios, and offers more renovation options than the FHA 203k loan. Homeowners should think about their needs and finances to pick the best loan for their renovation goals.

How should I choose between Homestyle and FHA 203k?

Are you renovating a vacation home or rental property? Go with a homestyle loan. Choose a homestyle renovation loan when you need to make extensive/luxury repairs.

Select FHA 203k when the property is your primary residence. FHA 203k is better if you have a low credit score.

Fannie Mae Homestyle Loan Vs. 203k (Experience & Reviews)

As a real-estate attorney and property manager, I would recommend an FHA 203k rehab loan. I have guided many clients through the process of using these loans to fund renovations on investment properties. As you know, you can finance up to 110% of the after-renovation value of the home.

For example, I worked with an investor buying a duplex that needed extensive repairs. The FHA 203k allowed them to borrow $160,000 to purchase the property, plus $40,000 for renovations, while keeping payments affordable. We oversaw contractors replacing the roof, updating electrical and plumbing, and remodeling the units. Within 6 months, the monthly rent had increased over 50%, and the property value soared.

In contrast, a HomeStyle renovation loan typically caps at 95% loan-to-value and 15-year terms. While useful for minor rehabs, the FHA 203k is better for major overhauls. The key is proactively managing contractors to ensure work is done correctly and on budget.

Garrett Ham, CEO, Weekender Management

FAQ

What are FHA 203k and Homestyle Renovation Loans?

With FHA 203k and Fannie Mae Homestyle Renovation Loans, you can finance the purchase and renovation of a property with a single loan. The loan amount is calculated against your property’s after-repair value. So you need to find a fixer-upper in a desirable neighborhood and improve the home’s value with repairs.

What are the eligibility requirements for an FHA 203k loan?

For a FHA 203k loan, you need a credit score of at least 580 and a debt-to-income ratio under 43%. You can use it for a single-family home, condos, or manufactured homes built after 1978. Your home must be your primary residence.

What are the eligibility requirements for a homestyle renovation loan?

The Homestyle Renovation Loan requires a credit score of 620 and a debt-to-income ratio of less than 45%. It’s for buying or refinancing a home, including condos and investment properties.

How does the renovation process work with an FHA 203k loan?

For FHA 203k, you need to hire a HUD consultant for over $35,000 in structural work. They manage the project and release funds as work is done.

How does the renovation process work with a homestyle loan?

No HUD consultant is needed. The lender holds renovation funds in escrow and releases them as work progresses. Homestyle offers up to 15 months for renovations, which is more than the 6-month timeline for FHA 203k.

Leave a Reply